Extended property holding is a strategic real estate investment approach that diversifies portfolios, navigates market fluctuations, and fosters sustainable growth. By combining thorough market analysis, efficient property management with modern technology, and a long-term perspective, investors can maximize returns while mitigating risk in the competitive real estate landscape. Staying informed on trends like smart homes and green building practices ensures investors maintain a competitive edge for substantial future gains.

In today’s dynamic real estate landscape, extended property holding offers a compelling strategy for sustained growth. This approach involves diversifying investments beyond traditional assets, tapping into emerging markets, and leveraging innovative financing methods. By exploring Unlocking Potential, Navigating the Market, and Maximizing Returns, investors can navigate the complex yet lucrative opportunities within the sector. Discover proven techniques to harness the power of real estate as a robust and ever-evolving investment vehicle.

Unlocking Potential: Strategies for Effective Extended Property Holding

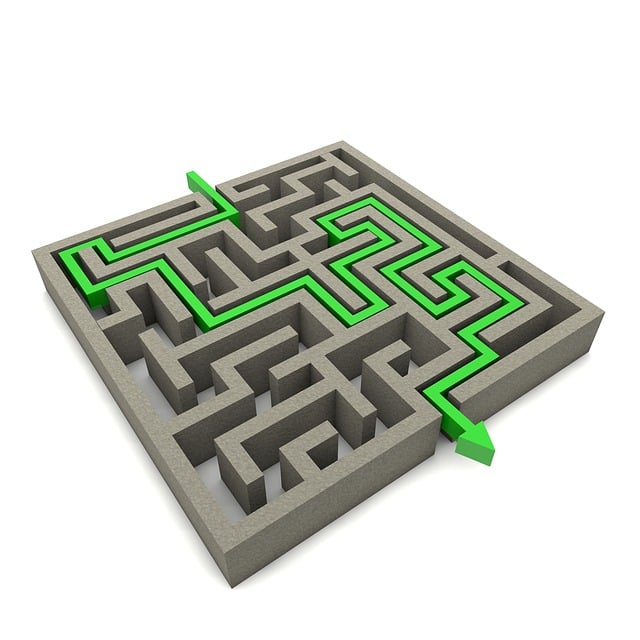

In the dynamic realm of real estate, extended property holding offers a strategic edge for investors seeking sustainable growth. Unlocking the full potential of this approach involves a nuanced understanding and implementation of specific strategies. Diversifying one’s portfolio by acquiring and managing a range of properties—from residential to commercial—enables investors to navigate market fluctuations effectively. This multifaceted approach not only mitigates risk but also provides opportunities for enhanced returns, as different property types often perform differently under varying economic conditions.

To maximize the benefits, investors should focus on thorough market analysis, prioritizing locations with strong growth prospects and stable demand. Efficient property management is key; utilizing modern technology to streamline operations can significantly improve profitability. Additionally, adopting a long-term perspective, coupled with flexible planning, allows for strategic adjustments as market trends evolve. By combining these strategies, real estate investors can harness the power of extended property holding, fostering organic growth and securing a competitive advantage in an ever-changing market.

Navigating the Market: Identifying Opportunities and Risk Management

Navigating the real estate market requires a keen eye for identifying promising investment opportunities while effectively managing risks. This involves extensive research to understand market trends, analyze demographic shifts, and assess local economies. Successful investors stay abreast of regulatory changes that can impact property values, ensuring they make informed decisions aligned with their strategic goals.

Risk management in extended property holding is key to long-term growth. Diversifying the portfolio across various asset types and geographic locations helps mitigate risks associated with a single market or property type. Additionally, establishing robust exit strategies allows investors to capitalize on rising markets while minimizing potential losses during downturns, ensuring adaptability and resilience in a dynamic real estate landscape.

Maximizing Returns: Growth Techniques and Future Prospects in Real Estate

In the competitive world of real estate, maximizing returns is a constant pursuit for investors and developers alike. Extended property holding, a strategy that involves acquiring and retaining assets over longer periods, offers a robust framework for achieving sustainable growth. By carefully selecting properties with high potential and implementing effective management practices, investors can capitalize on appreciation and rental income streams. This long-term approach allows for the accumulation of equity, providing a solid foundation for future investments.

Growth techniques in real estate often involve diversifying portfolios to mitigate risks. Investing in commercial, residential, or mixed-use properties can create a balanced portfolio that benefits from varied market dynamics. Additionally, staying attuned to emerging trends is crucial. Whether it’s the rise of smart homes, green building practices, or the shift towards urban living, adapting to these changes can position real estate investors for significant gains in the future.